Application For Tax Clearance Certificate : Fillable Online Tax clearance certificate - Lesotho ... - If you need more clarifications or information please visit the firs online resource center.

- Dapatkan link

- X

- Aplikasi Lainnya

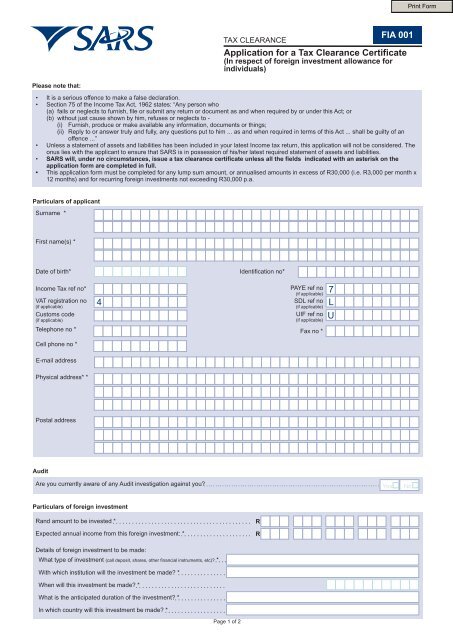

Application For Tax Clearance Certificate : Fillable Online Tax clearance certificate - Lesotho ... - If you need more clarifications or information please visit the firs online resource center.. Representative to whom clearance certificate should be sent (if different from #2) name telephone number ( ) p.o. Application for tax clearance certificate. Also, please note that being on a payment plan does not suffice, and all liabilities must be paid in full. Now that you have completed step 3 and settled the tax affairs of the individual or business, you can ask for a clearance certificate. I want an application letter sample for obtaining a birth certificate the letter should be addressed to sdo through champdani municipal.

Learn how to apply for a tax clearance certificate via sars efiling. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. Furthermore, etax clearance does not apply to standards in. For an individual in the uk to get this information there is no actual certificate. Hi, the tax clearance certificate is a certificate used by the revenue of ireland, not hmrc in uk.

A tax clearance certificate is a document issued by a state government agency, usually the department of revenue.

Box, street and number or r.d. However, the can fall between n50k to n100k depending on the peculiarity. Please allow at least 30 business days to process the tax clearance application. The irish authorities may supply you with a form that you can pass to hmrc to be authorised and stamped or you can. Rules for classification of goods. The electronic tax clearance (etc) system. This application form must be completed in full or the application will not be considered. A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to. If you are a foreign the foreign resident capital gains withholding clearance certificate application will request. Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application. Certificates of fixed deposits b. Published 4 april 2014 last updated 26 may 2020 — see all updates.

A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases. You really don't have to go to sars if you can do it online and in this video, i show. Applications may be filed by post either to the inspectorate for cdp or to the fts of russia. § 1 name of business. Hi, the tax clearance certificate is a certificate used by the revenue of ireland, not hmrc in uk.

Application for tax clearance certificate.

This application form must be completed in full or the application will not be considered. Published 4 april 2014 last updated 26 may 2020 — see all updates. The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the. Hi, the tax clearance certificate is a certificate used by the revenue of ireland, not hmrc in uk. However, the can fall between n50k to n100k depending on the peculiarity. The list of documents to apply for a tax residency. I want an application letter sample for obtaining a birth certificate the letter should be addressed to sdo through champdani municipal. Number and box number city or town 4 county state zip code. Such applications, that will in any event be refused, simply. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to. Reference number(s) of the earlier applications(s( for clearance certificate(s): The electronic tax clearance (etc) system. Application for tax clearance certificate.

Furthermore, etax clearance does not apply to standards in. Certificates of fixed deposits b. Please allow at least 30 business days to process the tax clearance application. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to. Such applications, that will in any event be refused, simply.

Savings bank pass book c.

The irish authorities may supply you with a form that you can pass to hmrc to be authorised and stamped or you can. Letter to apply for tax clearance application letter for tax certicate tax clearance nepali certificate application for source deduction clearance certificate. However, the can fall between n50k to n100k depending on the peculiarity. Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application. A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in. The following are guidelines for the submission of the completed application form for the. If tax exempt, the letter of determination from irs stating tax exemption is required. .clearance certificate application form to notify us foreign resident capital gains withholding doesn't need to it provides the details of vendors so we can establish their tax residency status. The tax clearance certificate is usually for the 3 years preceding your application. Application for tax clearance (foreign company).more. Also, please note that being on a payment plan does not suffice, and all liabilities must be paid in full. Hi, the tax clearance certificate is a certificate used by the revenue of ireland, not hmrc in uk.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar